Gone are the days when unexpected expenses meant figuring out where to arrange funds from. Personal loans have revolutionised the financial landscape, offering salaried individuals

Salaried individuals may find themselves in need of some quick cash at times, not just as the month draws to a close, but also for other reasons. At times, you might not be in a fix but need extra cash for an unplanned vacation for a much-needed break, or maybe you feel like getting a nice gift for your spouse or partner with an anniversary approaching, or you might just want to go out with friends who are in town after a long time. No matter what the reason, you might find yourself in need of funds during the month, and an advance salary loan can be of immense help in such times.

What is an Advance Salary Loan?

As the name suggests, an advance salary loan, also called a salary advance loan, is granted to salaried professionals to access immediate funds when their regular salary is insufficient to make immediate payments. It is a type of personal loan offered by banks and other financial institutions that helps borrowers in getting access to money ahead of their upcoming paycheck.

For those who find themselves in need of emergency funds, an advance salary loan can be an ideal solution.

The interest rate for this type of loan is calculated against your salary and is typically higher than most personal loans. Furthermore, these loans are generally easy and quick to apply for and can be approved within just 24 hours after application submission. Lenders will check your credit score along with other eligibility criteria before lending to you.

Situations that Might Call for a Salary Advance Loan

An advance salary loan can help you in several situations. Be it for birthday celebrations, gifts for special occasions, unplanned vacations or trips, school expenses, etc., and is not always limited to end-of-the-month crunch. It is a useful financial tool when borrowing makes sense for you.

Let’s take a look at some common situations when you might consider getting an advance on our salary:

-

01Bill Payments

Most of the time, you have typically put aside your salary for bill payments, but there are instances when some unforeseen expenses could creep in before your due dates. And so, when it's time to pay your bills, it could mean that you are running short of cash. An advance salary loan can help you pay your bills on time.

-

02Unplanned School Expenses

Some school matters for your child cannot be delayed, especially as they come with submission deadlines that all students have to adhere to. These are typically project-related expenses, and these projects, at times, can come in towards the end of the month without prior notice for you to plan for them. And since you cannot control when these occur, an instant salary advance loan can help you provide your child with the needed resources on time. Other school-related expenses can also be school trips, outings, camps, and even fees at times.

-

03Repairs and Maintenance

All of us have to deal with repairs of some sort or the other, and for most of them, we do not have a budget that we typically set aside. Repairs can be of various types – home repairs that could mean plumbing needs, electrical faults, or even repairs of important day-to-day durables like your washing machine, fridge, AC, oven, geyser, etc., which might need repairs. You could also find yourself in need of a car or two-wheeler repairs. Pretty much anything that can hinder your daily function would need you to shell out cash to ensure that it is fixed, and if it's towards the end of the month, an advance salary loan can be your saviour.

-

04Urgent Travel

Most of us set aside a budget and pre-plan vacations and other travels, but there are times when you might be faced with unplanned and urgent travel. You might need to visit a family or friend due to illness, there could be some celebration that you need to attend out of town on short notice, etc. In such times, a salary advance loan might just be what can make the travel possible for you.

-

05Rent or Deposit Due to a Recent Move

Finding accommodation in new cities, especially in the area you prefer, is already a huge hassle in itself. And when you find a house for rent, putting down a deposit for booking might cause an inconvenience. Waiting for your next month's salary is also not practical in this situation as it might cause you to lose out on a good place, so a salary advance loan can be helpful.

-

06Celebrations and Occasions

When you have an opportunity to celebrate in life, funds shouldn’t hold you back. Celebrating a loved one, a promotion, an anniversary or birthday, a friend’s visit, a wedding in the family - pretty much any life event can be turned into a celebration, and at such times, a quick help in the form of a salary advance allows you to enjoy the moment and worry about finances a little later. Just make sure you plan properly and pay it off in time.

How Does an Advance Salary Loan Work?

Today, with the help of several NBFCs and FinTech lenders, you can curb your financial crisis with their various available options of flexible loan products. One such boon to a salaried individual has been an advance salary loan.

All you need are the required documents once you match the eligibility criteria that are specific to the lender. The lender will then check your credit score, verify the submitted documents, see whether your salary range falls within their criteria, and give you a loan amount that is right for you.

One of the best ways to get a loan instantly is from the online loan platform known as KreditBee.

How KreditBee's Instant Loan Can Help When You Need a Salary Advance

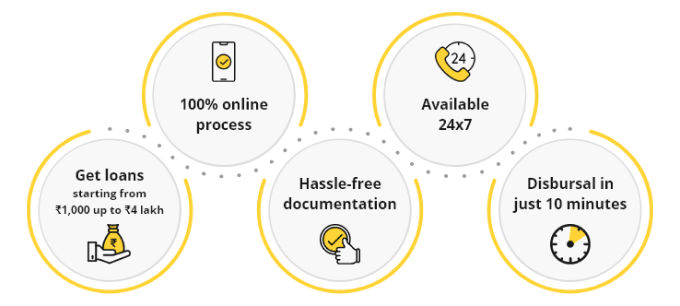

With KreditBee, a salaried individual can benefit from a loan without having to wait for days or weeks to get the loan approval. Here are some of the best features of applying for a loan that can work as an instant salary advance loan online with KreditBee:

- Get loans starting from ₹3,000 up to ₹5 lakh

- 100% online process

- Hassle-free documentation

- Available 24x7

- Disbursal in just 10 minutes

How to Get an Advance Salary Loan

KreditBee's hassle-free documentation process makes it possible for every salaried individual (who falls in the simple eligibility criteria) to get access to an instant loan that works just like an advance salary loan that is disbursed into their account in 10 minutes!

Here's how you can take advantage of our fintech platform:

-

01Sign up using your mobile number

-

02Enter your personal information like name, age, salary, PAN number, etc.

-

03Verify your profile with KYC documents and provide employment proof

-

04Enter bank account details

-

05Choose the amount and tenure of your loan

-

06Get your loan disbursed into your bank account in just 10 minutes

Documents and Eligibility at KreditBee When You Need an Advance Salary Loan

| Documents | Eligibility |

|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

| Documents |

|---|

|

|

|

|

|

|

|

|

| Eligibility |

|---|

|

|

|

|

|

|

|

|

Advance Salary Loan for Quick Funds

In conclusion, let’s do a quick recap - when you need funds during the month and can’t wait or rely on your salary, you can choose to get a salary advance loan that you can borrow against your salary. A few points to remember are - These loans are short-term, and you need to plan to pay them back quicker than you would if you had borrowed a personal loan. The interest rate will typically be higher. And, you must be a salaried employee.

Now, let’s take a look at some commonly and frequently asked questions pertaining to

An advance salary loan is a good option compared to other loans when you are in need of quick cash and are able to pay it back in the short term. It all depends on what you need at the moment and what terms you are okay with, so always do your research and pick a loan best suited to your needs.

Advance salary loans are short-term loans usually offered for a shorter tenure. The repayment period differs from lender to lender, but most commonly, it is 3 to 12 months. That said, there are some lenders who offer tenure of 30 or 90 days, and some might extend it to 15 to 24 months as well. At KreditBee, the repayment tenure lasts from 3 to 24 months.

With KreditBee's instant loan disbursal and 100% online documentation process, a salaried employee can get a loan starting from ₹3000 up to ₹5 lakh.

The advance salary loan online makes use of an EMI calculator to determine your repayment tenure, as well as the interest rate.

The approvals for most advance salary loans happen pretty fast - usually within 24 hours. If you match the easy eligibility criteria and submit the required documents to KreditBee, you can disburse your loan into your bank account in just 10 minutes.

| Category | Personal Loan | Advance Salary Loan |

|---|---|---|

| Who offers it | Most lenders | Only few offer |

| Eligibility | Both salaried and self employed | Only salaried individual |

| Loan type | can be short to long term | Mostly availabe short term |

AUTHOR

KreditBee As a market leader in the Fintech industry, we strive to bring you the best information to help you manage finances better. These blogs aim to make complicated monetary matters a whole lot simpler.