Waiting for your PAN card can be stressful, especially when financial transactions and official matters depend on it. That’s why the process of tracking your PAN card delivery status is crucial. Being mindful of this, the Income Tax Department and other relevant authorities have streamlined the process, making it easier for applicants to monitor the progress of their PAN card dispatch.

Have you ever wondered how you can efficiently monitor the status of your PAN card delivery? In this blog, you will get to explore the significance of being updated on your PAN card dispatch status with a detailed guide on how to track PAN card delivery status using speed post and consignment numbers.

What is a PAN Card?

A PAN card is an essential official document issued by the Indian government that records a taxpayer’s identification number. It includes important information such as your name, date of birth, and a unique 10-digit alphanumeric code. This document acts as primary proof of an individual's identity.

Why is Tracking PAN Card Delivery Status Important?

Tracking your PAN card dispatch status is vital for several reasons:

- Proof of Identity and Financial Transactions: PAN cards are mandatory for financial activities, including opening bank accounts, filing taxes, and applying for loans.

- Verification: PAN cards serve as proof of identity and are required for KYC (Know Your Customer) processes.

- Prevent Delays: Tracking your PAN card by post office helps you avoid delays in receiving your PAN card, which can hinder financial transactions and other important activities.

How to Check PAN Card Delivery Status?

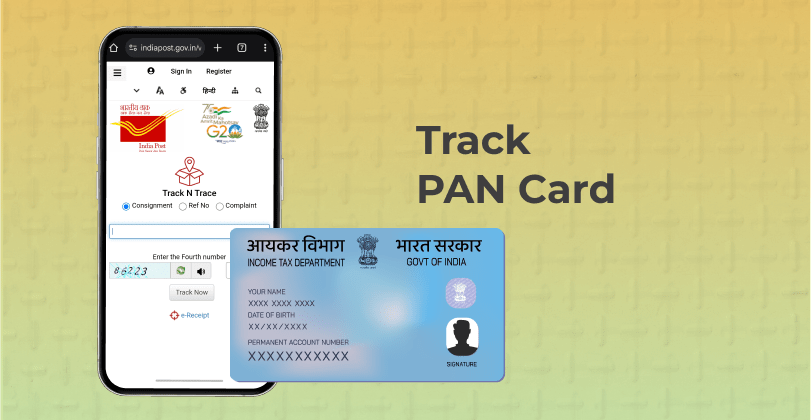

Let’s examine a step-by-step guide on how to track your PAN using a speed post and consignment number.

Step 1: Obtain your consignment number. This step is done automatically, as once your PAN card is dispatched, you will receive a consignment number via SMS or email.

Step 2: Visit the India Post website to start tracking your PAN card delivery status.

Step 3: Enter the consignment number in the tracking section.

Step 4: Track your PAN card by clicking on the search button to view its current status and location.

Importance of PAN Card

A PAN card is more than a piece of plastic. It serves as an identity proof for various purposes. Let’s take a look at these aspects.

- Financial Transactions

- Loan Applications: When applying for loans, lenders require a PAN card to verify your identity and credit history.

- Bank Accounts: PAN cards are necessary for opening bank accounts.

- Investments: PAN cards are required for investing in mutual funds, stocks, and other financial instruments.

- Legal and Tax Purposes

- Tax Filing: PAN cards are mandatory for filing income tax returns.

- High-Value Transactions: Any transaction exceeding ₹50,000 requires a PAN card for verification.

- General Identification

- KYC Processes: PAN cards are used for KYC verifications in various institutions.

- Identity Proof: PAN cards serve as valid ID proof for various purposes, including applying for other government documents.

Secure Your Financial Future: Track Your PAN Card Delivery Status

Keeping track of your PAN delivery status is essential to avoid any delays that could affect your daily activities. With the increasing dependence on digital financial tools and services, timely receipt of your PAN card is more crucial than ever.

To make this process smoother, you can even track your PAN card using speed post and consignment numbers. Remember, your PAN card is more than just an ID—it's a gateway to managing your financial life without any hiccups, enabling smooth interactions with banks, investment platforms, and government services.

Before You Go…

Looking for a personal loan tailored for salaried individuals? Check out KreditBee’s personal loan options, which offer flexible repayment options ranging from 3 to 36 months for amounts between ₹10,000 and ₹5 Lakhs. It’s the perfect choice for managing unexpected expenses or achieving your financial goals.

Frequently Asked Questions(FAQs)

A PAN (Permanent Account Number) card is an official government document that records a taxpayer's identification number and includes details such as name, date of birth, and a unique 10-digit alphanumeric code.

The required documents include proof of address and date of birth. These can be documents like an Aadhaar card, voter ID, passport, or birth certificate.

Yes, absolutely, NRIs can also apply for a PAN card online by following the same process as residents, with additional documents required for overseas address proof.

In India, obtaining a PAN card usually takes about 15 to 20 working days from the date of application. However, the processing time may vary depending on the method of application and the accuracy of the submitted documents. Online applications generally speed up the process, with some applicants receiving their PAN cards within a week. For the most accurate timeline, you can always check the status on the official PAN website.

Yes, a PAN card is frequently required as proof of identity and age when applying for a loan. It is an essential document to verify the applicant's identity, ensuring that the details provided are accurate and trustworthy. By assessing the applicant's PAN card information, financial institutions can evaluate their eligibility more effectively, thus facilitating a smoother and more reliable loan approval process.

AUTHOR

KreditBee As a market leader in the Fintech industry, we strive to bring you the best information to help you manage finances better. These blogs aim to make complicated monetary matters a whole lot simpler.